“Why are my people leaving and what can I do about it?”

– Hospital Director

– Hospital Director

Heart of Chelsea Group is an AAHA accredited, 3-location business recognized for its top-notch management, outstanding client service, and high quality medical care. The owner and manager were searching for a personalized, yet cost-effective way to demonstrate they care about their doctor team’s financial wellbeing.

The following background and three employee vignettes are composite profiles that highlight common financial challenges and opportunities facing clinics and their staff. Names have been changed to protect the privacy of employees.

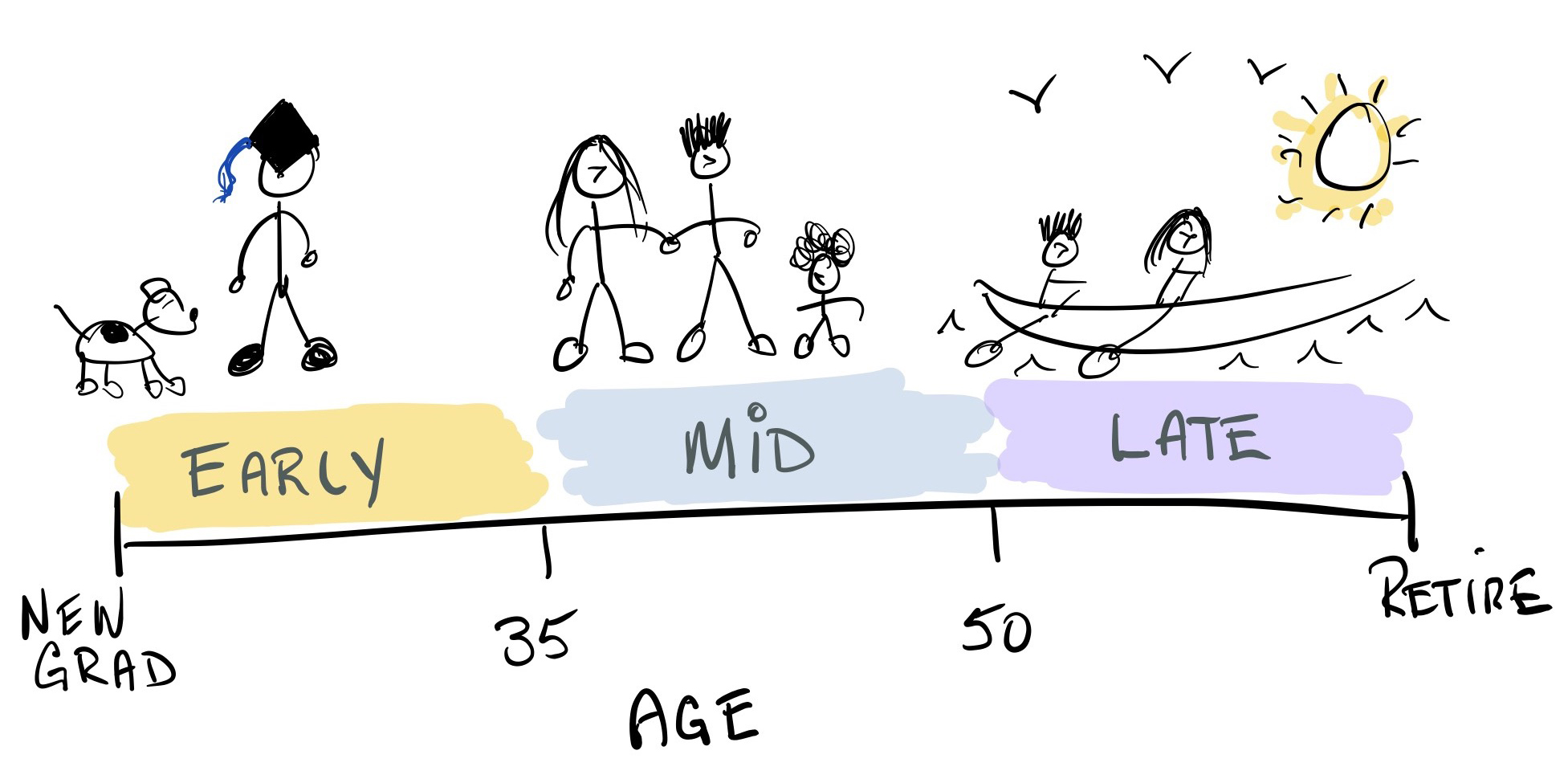

Jen is engaged to be married in the next six months. She is facing her very first student loan payment in 2023. Jen wants to feel more “planned-out” on her student loans so that she can pursue more meaningful goals. She wonders whether to use money earmarked for her upcoming wedding to pay back her student loans faster.

Prior to reaching out to Sabadoodle, Jen was introduced to a “financial advisor” affiliated with a big life insurance company. Jen asked the advisor for clarity on her student loans. The advisor sold her a whole life insurance policy without even addressing her primary concern…her mortgage-sized student loan debt.

We help Jen manage her loans in a way that allows her to focus more dollars on her Why: the upcoming wedding, future home purchase, and starting a family.

She now has the insight to look beyond debt repayment with an eye toward more fulfilling goals.

Beth rents a cramped New York City apartment and is expecting her second child. Her household income is rising but the cost of raising kids seems to increase just as fast…and every dollar earned is spoken for.

Fluctuating production bonuses make managing her student loans even more complex.

Before making a big financial decision like buying a home, we help Beth model it in our financial planning software first. Virtual mistakes cost a lot less than the real kind!

We help Beth and her husband get crystal clear on household money inflows and outflows so that they can direct more dollars toward a home down payment.

The Sabdoodle process provided the couple a safe place for reflection…and gave them the confidence to take the first step in a new direction.

Kathy’s most deeply held value is making a difference in the lives of pets.

Prior to working with Sabadoodle, she had never spoken to a financial planner. (Kathy thought that because she didn’t have a large investment account, she would have no opportunity to work with a financial planner.)

Kathy is a career changer and graduated from veterinary school later in life. Paying off her student loan debt had been her biggest financial priority, not saving for retirement.

Her financial priorities have changed now that the student loans are in the rear-view mirror.

Kathy assumed she would need to work full-time until at least age 67. The Sabadoodle process showed her that she could take steps now that would allow her to shift to part-time work at age 60 and full retirement at age 65.

Kathy is suddenly excited about her future!