Veterinarians in their 40s and 50s tell me they are playing catch up on their money life.

But chasing all of your financial goals at once is exhausting.

There’s a better way.

I recently worked with a mid-career veterinarian; we’ll call Megan Clark. Megan is married to Tim, a police officer. The Clarks are in their mid 40s. Megan is the medical director at a five-doctor practice that recently became corporate owned. She is set to make her final student loan payment this month. The Clarks have two children – ages five and three.

In recent years, Megan’s dreams have turned to working less so that she can spend more time with her kids. This puts Megan at odds with her long-held goal of practice ownership…and brings added stress to her marriage.

Here’s how my conversation with Megan unfolded:

Mike: Besides practice ownership, what gets you excited?

Megan: I’ve been thinking more and more about relief work.

Mike: Tell me about that…

Megan: Well…I’d have a lot more flexibility to my day…and to be honest I’m tired of all the drama at work.

Mike: What’s holding you back?

(She pauses and glances at Tim)

Megan: It feels like a step back financially…

Mike: How so?

Megan: I’m making good money now…and my gosh I JUST paid off all the student loans. I DO want to be able to retire….if that’s even a possibility.

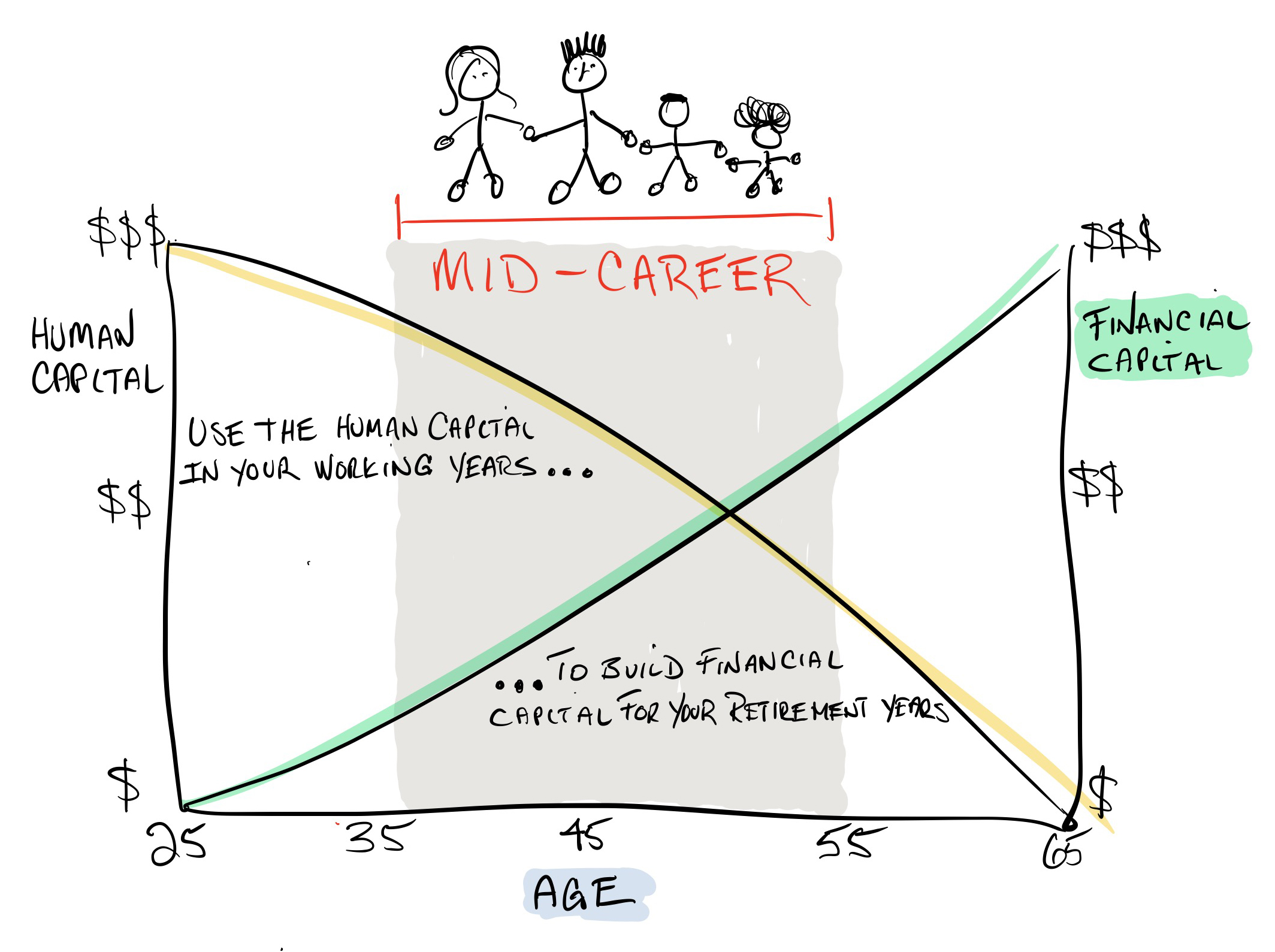

As shown in the doodle above, a veterinarian’s mid-career ranges from their late 30s into their early 50s. On average, mid-career doctors have more income, less student debt, and higher levels of financial capital (green line) compared to early-career veterinarians. Some might think mid-career individuals are on the fast track to financial freedom. But that’s rarely the case…and here’s why.

Veterinarians often tell me that they are experiencing a change in perspective. An individual’s values often shift with life experience. Mid-career veterinarians no longer have the capacity to pour all their time and energy into their career. They still want to be great doctors but they have a strong desire to be even better spouses and parents.

Student loans are largely a thing of the past for many veterinarians in their 40s and 50s. Mortgage and/or practice loans have taken the place of education debt as a major recurring expense. Household income is rising but the cost of raising kids seems to increase just as fast…and every dollar that comes in the door is spoken for.

Mid-career veterinarians like the Clarks feel they are not making enough progress on saving for retirement or their kid’s college education.

So, I asked Megan and Tim to look at their financial to do-list in new way:

As shown in the doodle above, we used financial planning software to prioritize their goals, assign a cost, and build a timeline. A financial plan is simply a blueprint for matching money with your most important goals. The Clarks agreed that their goal over the next six-months would be Megan’s successful transition to relief work.

We got busy setting out next steps:

- 1. I asked Megan and Tim to get crystal clear on their household money inflows and outflows.

- 2. We used the information from Step 1 to develop a spending plan.

- 3. We brainstormed ways to build cash reserves to supplement Megan’s expected reduction in income.

- 4. Meanwhile, Megan made discreet inquiries to friends and colleagues about how/where she could source relief work.

- 5. Finally, we mapped out a 3-year cash flow plan (the time Megan thought it would take to return her income to its prior level).

The Clarks understood there would be more sacrifices ahead, but both agreed it would be well worth it in the long run. When the time was right, Megan was ready and able to step into her new career!

It’s easy to get weighed down by thoughts of the future. For Megan and Tim, financial planning provided a safe place for reflection…and gave them the confidence to take the first step in a new direction.

Our next post will look at the financial opportunities and challenges facing late-career veterinarians.