Financial messages directed toward early-career vets seem to focus almost entirely on how to manage student loan debt.

Educational debt gets the most attention because it’s like the tip of a massive iceberg – impossible to ignore from sea level.

They say that context depends on one’s vantage point.

What I’ve learned from working with dozens of veterinarians is that the most meaningful financial goals often lie beneath the surface. Just like an iceberg, the interesting part is hard to see.

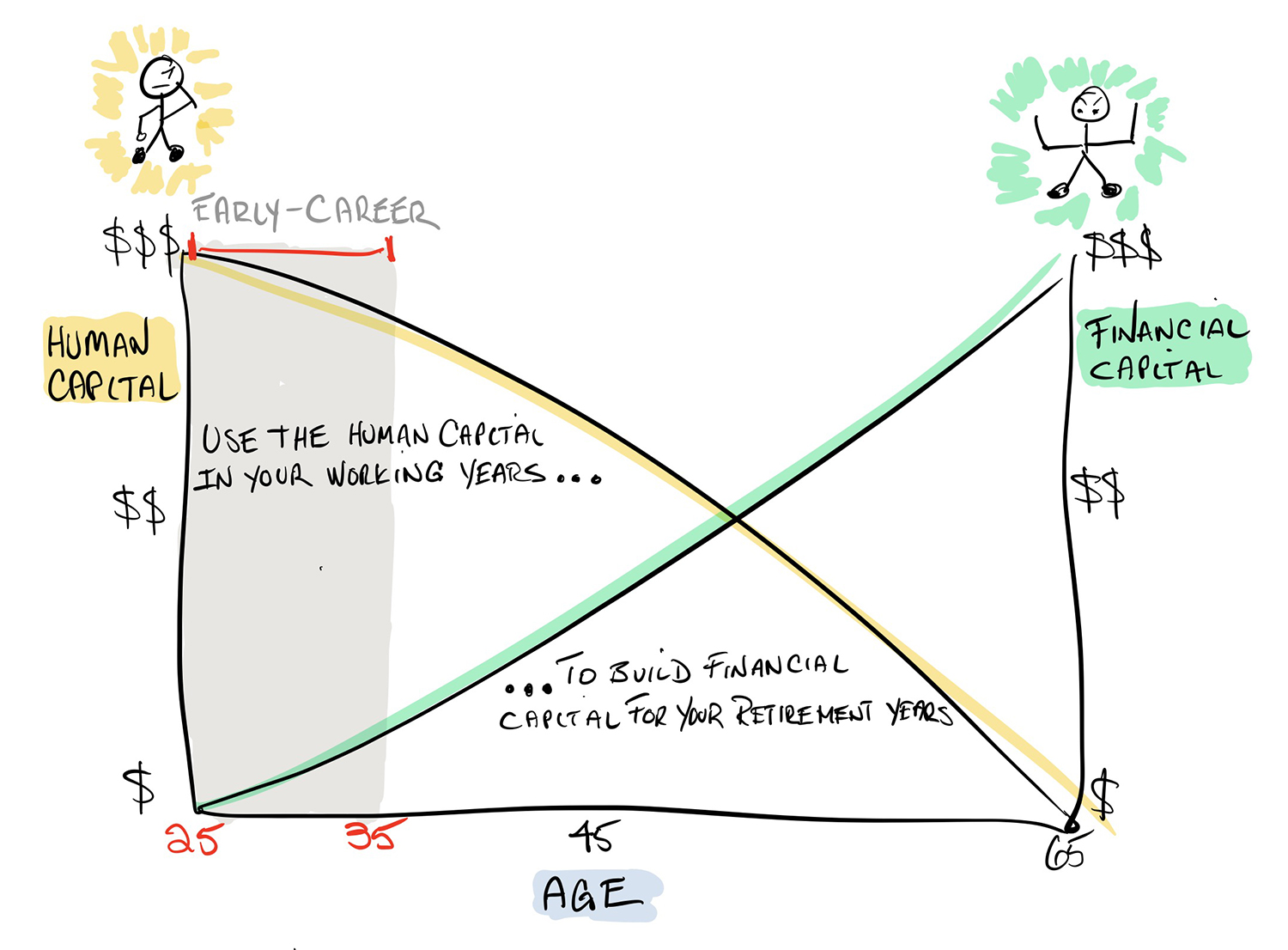

A veterinarian’s financial goals vary widely depending on the person’s career stage.

The three stages of a veterinarian’s career:

- Early career

- Mid-career

- Late career

I recently spoke to an early career vet with six-figure student loan debt. We’ll call him John Smith. John was married and had a toddler. He felt held back by his student loans and was afraid to make financial decisions. John and his wife Jane wanted to gain financial clarity and live a “normal” lifestyle.

The Smiths had managed to build some savings and wondered whether to use these funds to pay down student debt, buy out their car lease, or purchase a home.

They asked friends, family and colleagues for advice but came away feeling even more confused and uncertain.

Together we built a financial plan that helped them gain the clarity they were looking for. Some think a financial plan is all about investing for retirement. In fact, retirement investing was the least of John’s worries. His biggest fear was that a student loan tax bomb was waiting to explode his future finances.

The Smith’s financial plan helped them see that at the current pace John’s student loans would be paid off five years earlier than he expected and result in zero tax liability. With this added insight, in the here and now, the Smiths felt confident they had enough cash reserve to buy the car while beginning to save for a home.

Financial planning is how I help veterinarians connect their dollars with what’s most important in their lives. It’s as much a conversation about values as it is about numbers.

Clinical practice is stressful enough. Imagine for a moment what it would feel like to be in control of your money life.

In the next post, we’ll take a closer look at the financial opportunities and challenges facing mid-career vets.