Veterinarians of all ages tell me they want financial independence.

But many new grads fear they’ll be paying back student loan debt until the day they die.

No wonder many early-career doctors are afraid to make financial decisions.

If you feel you’re playing catch up on your financial goals, that’s OK. You’re not alone.

The truth is that most veterinarians build wealth by little actions taken over long periods of time. It’s a marathon, not a sprint.

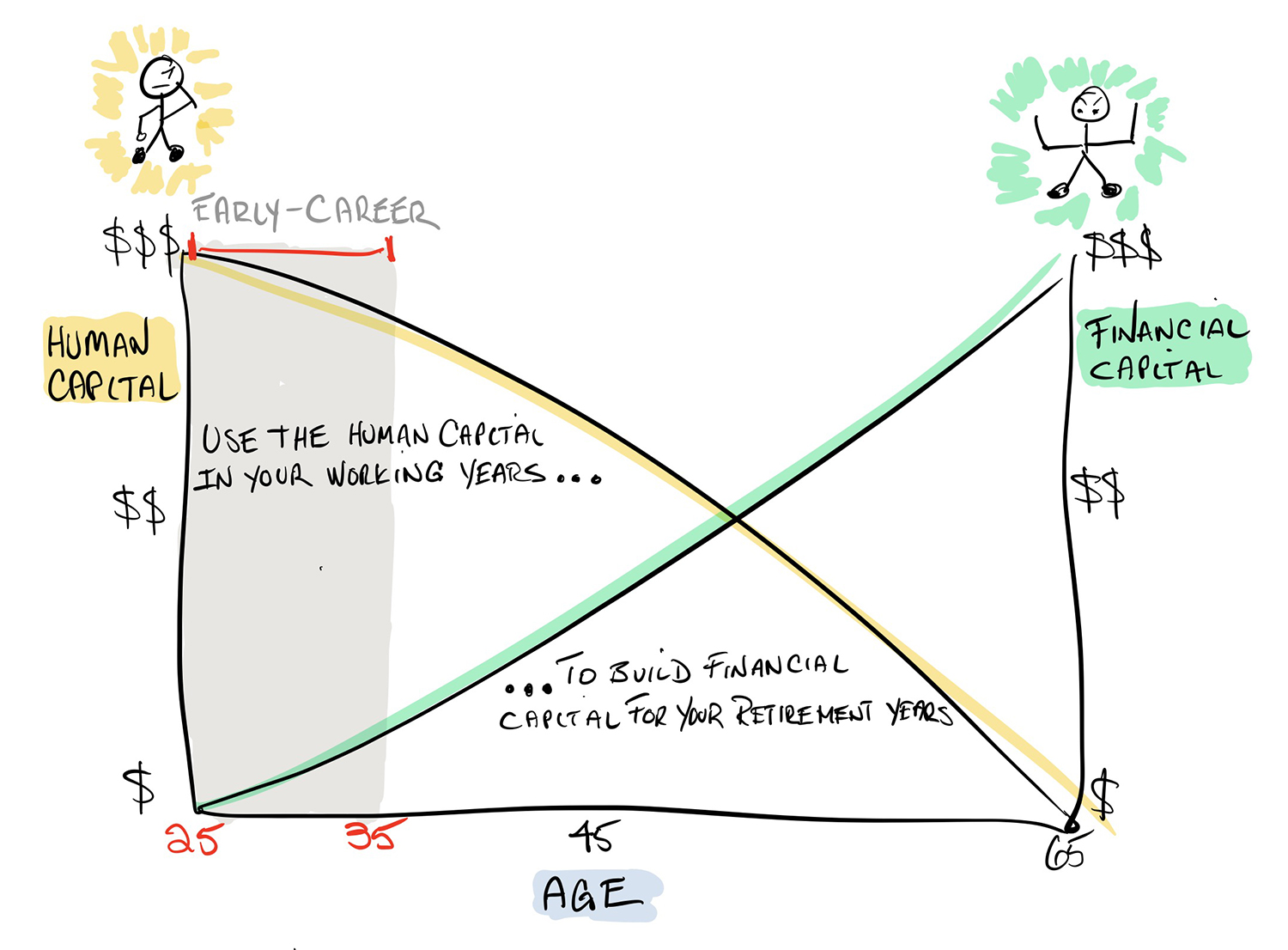

This doodle shows a path to financial independence.

Unlike late-career veterinarians, new grads have decades of future earnings power ahead of themselves. Economists call this human capital. A veterinarian’s total wealth consists of human capital (yellow line), which is converted over time to financial capital in the form of retirement accounts, investment accounts, real estate, and practice ownership (green line).

The net worth of an early career veterinarian is mostly human capital (top left corner). The great news is that early-career veterinarians are wealthier than they think. For perspective, the human capital value today for a newly minted DVM earning $100,000 is in the neighborhood of $3,000,000.

The road to financial independence always begins with a plan.

It’s tempting to kick the can down the road thinking you’ll get to it next year. That would be a big mistake, especially for early career veterinarians.

Achieving financial independence depends on the choices and actions you take now.

In future posts, we’ll look at the unique planning opportunities and challenges for three groups of veterinarians:

- 1. Early-career: (35 years old and under)

- 2. Mid-career (36-49)

- 3. Late-career (50+)