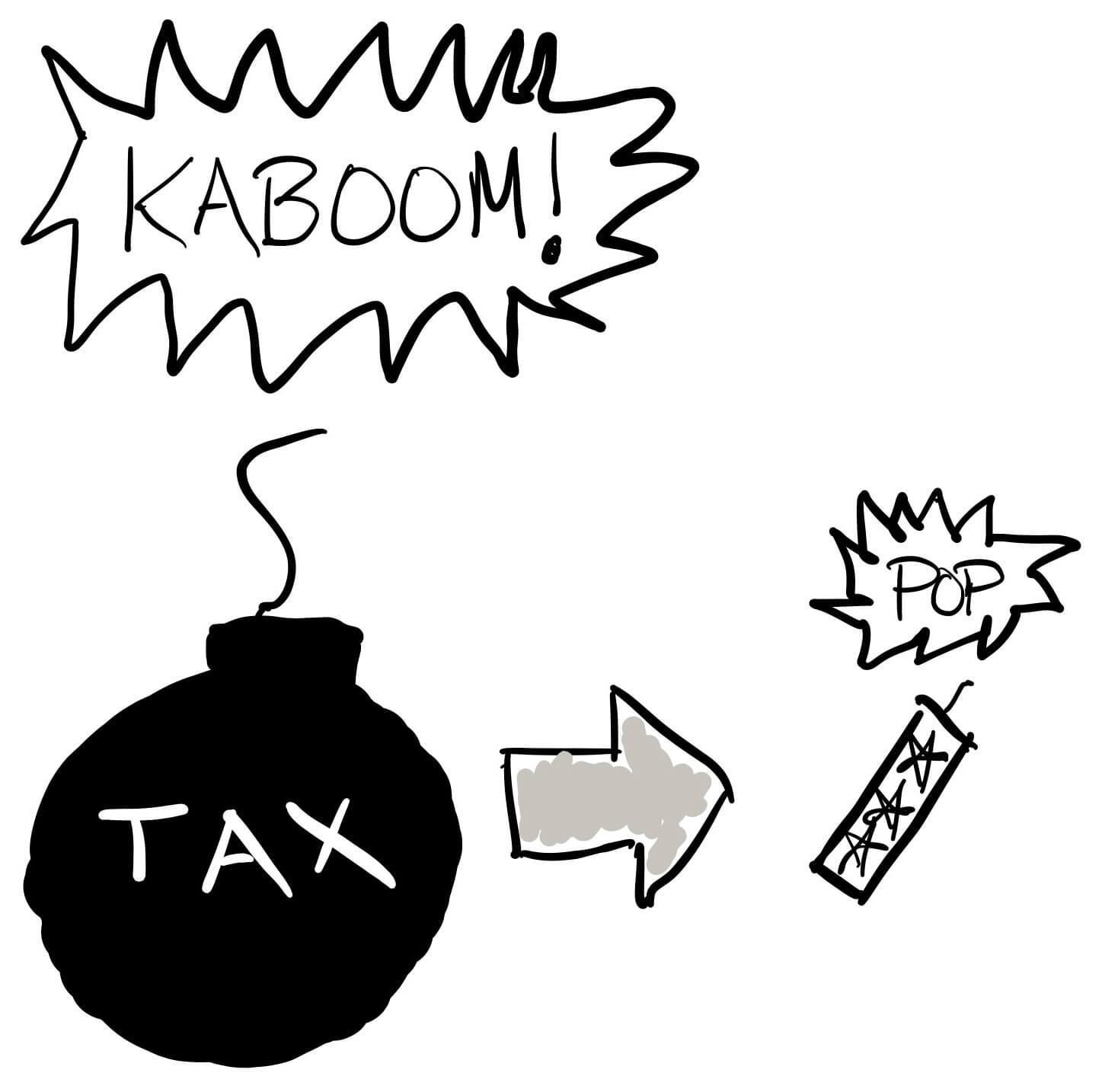

Myth: A tax bomb is waiting to explode your future finances.

The tax bomb is all you hear about when it comes to the end of student loan repayment. No wonder many veterinarians feel trapped by their student loan debt! Here’s my question: Is it really a tax bomb or just a wimpy firecracker?

A common mistake I see is that new veterinarians focus on Pay As You Earn’s (PAYE) low monthly payment but lack the clarity to save for the potential tax liability that may come at the end of repayment.

Tax bomb or tax firecracker?

A student loan forgiveness tax has the potential to be a wimpy firecracker rather than a megaton bomb.

The bomb only explodes if you don’t defuse it!

You can defuse the tax bomb by consistently investing small amounts of money beginning now so that you’re in a position in 20 years to write a check to the IRS. Broken down over two decades, the monthly savings required to meet your projected tax is less than you might think.

What if taxable loan forgiveness is eliminated at some point in the future? In that case, money in a forgiveness fund is yours to do whatever you want.

The point is to focus on the things you can actually control and work the current rules to your advantage. In the meantime, you’ll gain confidence and peace of mind because you’ve defused the tax bomb.